At the G7 Agriculture meeting in Ortigia (Syracuse), UIV, Ismea, and Assoenologi presented their estimates for the 2024 Italian wine harvest. Frescobaldi stated, “We need a more flexible Italian vineyard, able to adapt to changing conditions,” while Cotarella described it as “one of the most challenging harvests in my long career as an oenologist.”

The Italian wine sector is facing a period of significant complexity, with challenges ranging from rising production costs and a declining market to climate change and evolving consumer preferences. Despite these hurdles, Italy has shown greater resilience than its competitors, particularly France.

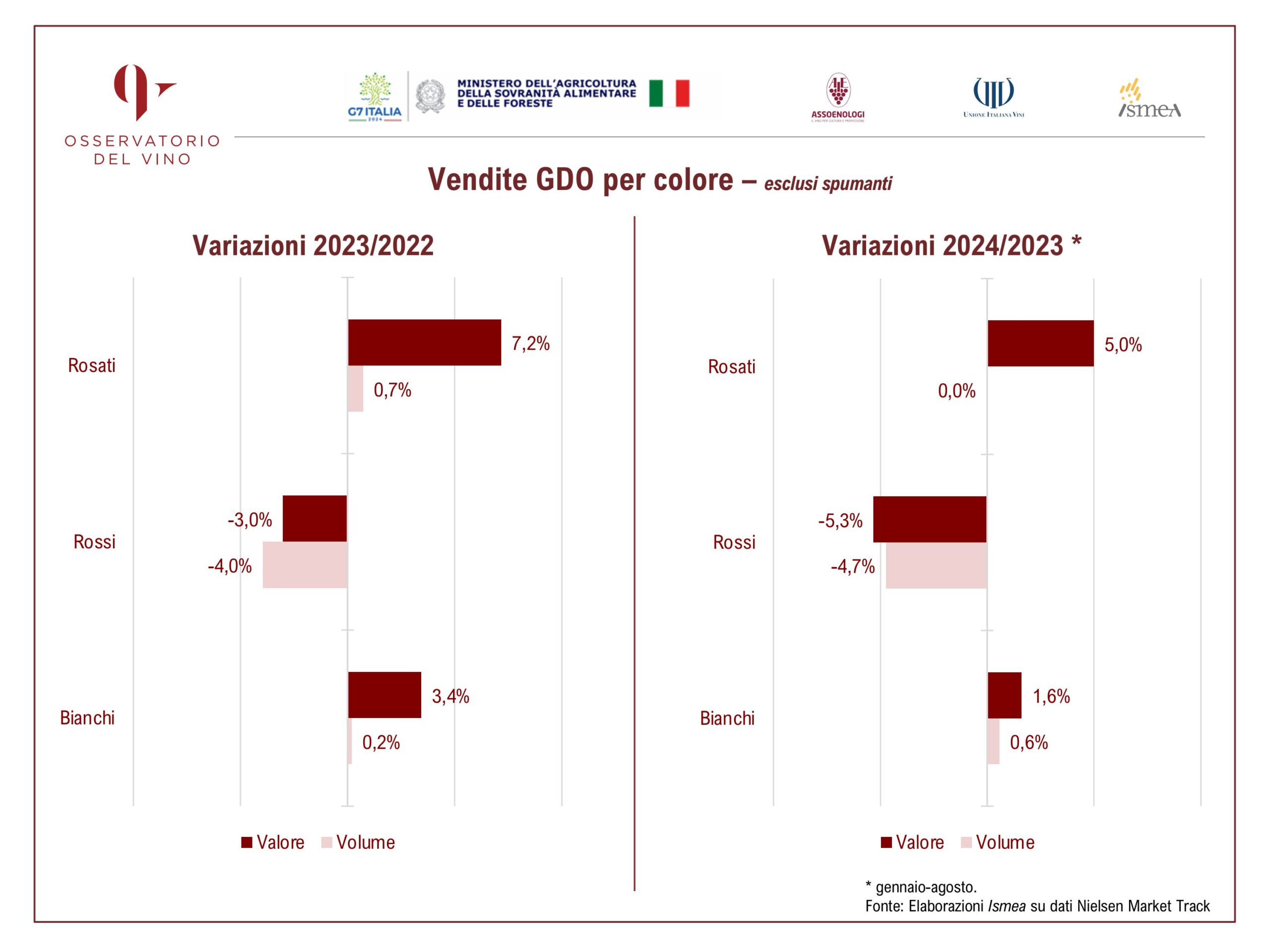

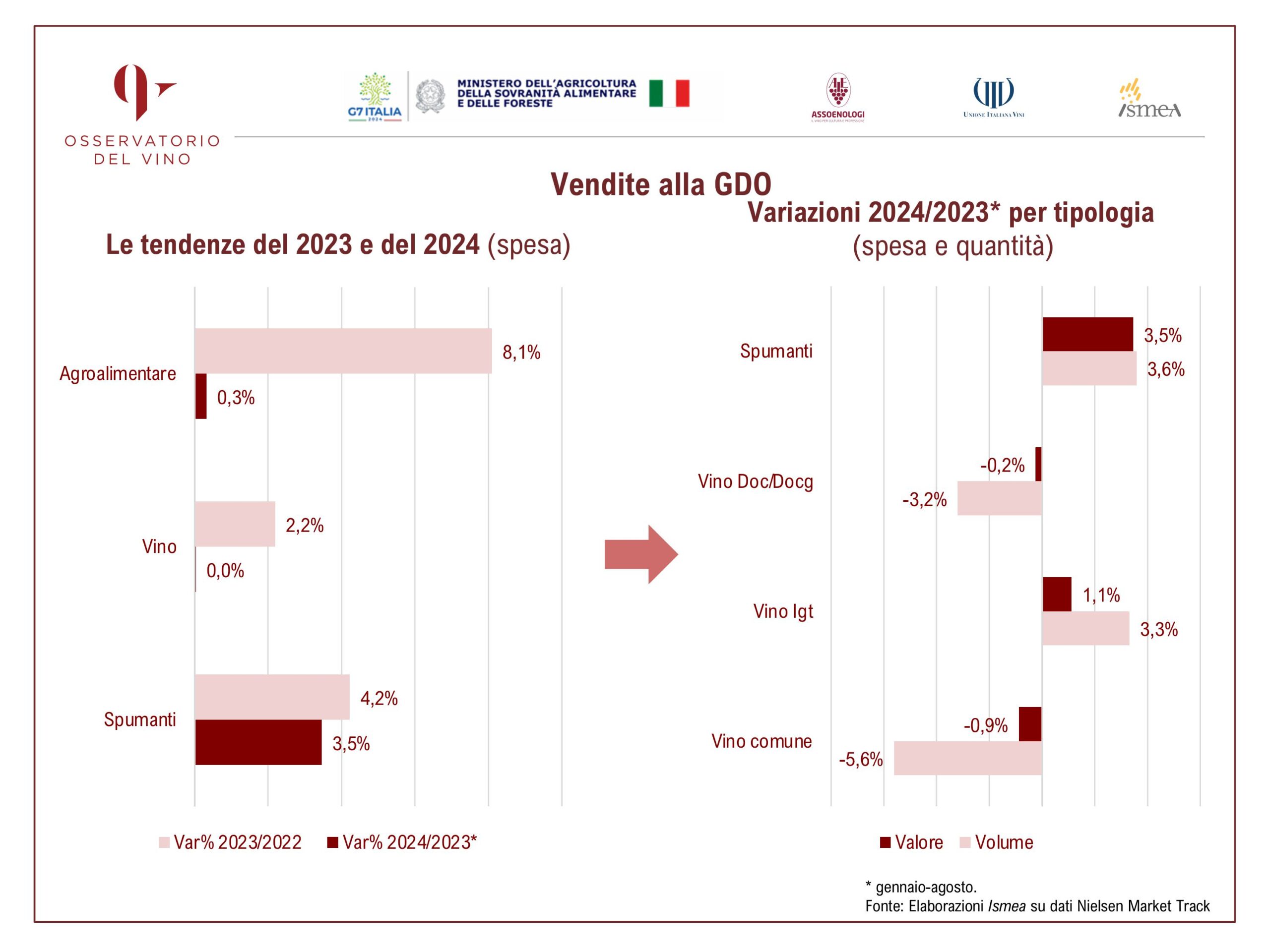

The 2024 harvest, characterized by a smaller production, has put significant strain on producers, who have had to contend with rising prices and a distribution network that has been slow to adapt. Domestic consumption is down, especially for still wines.

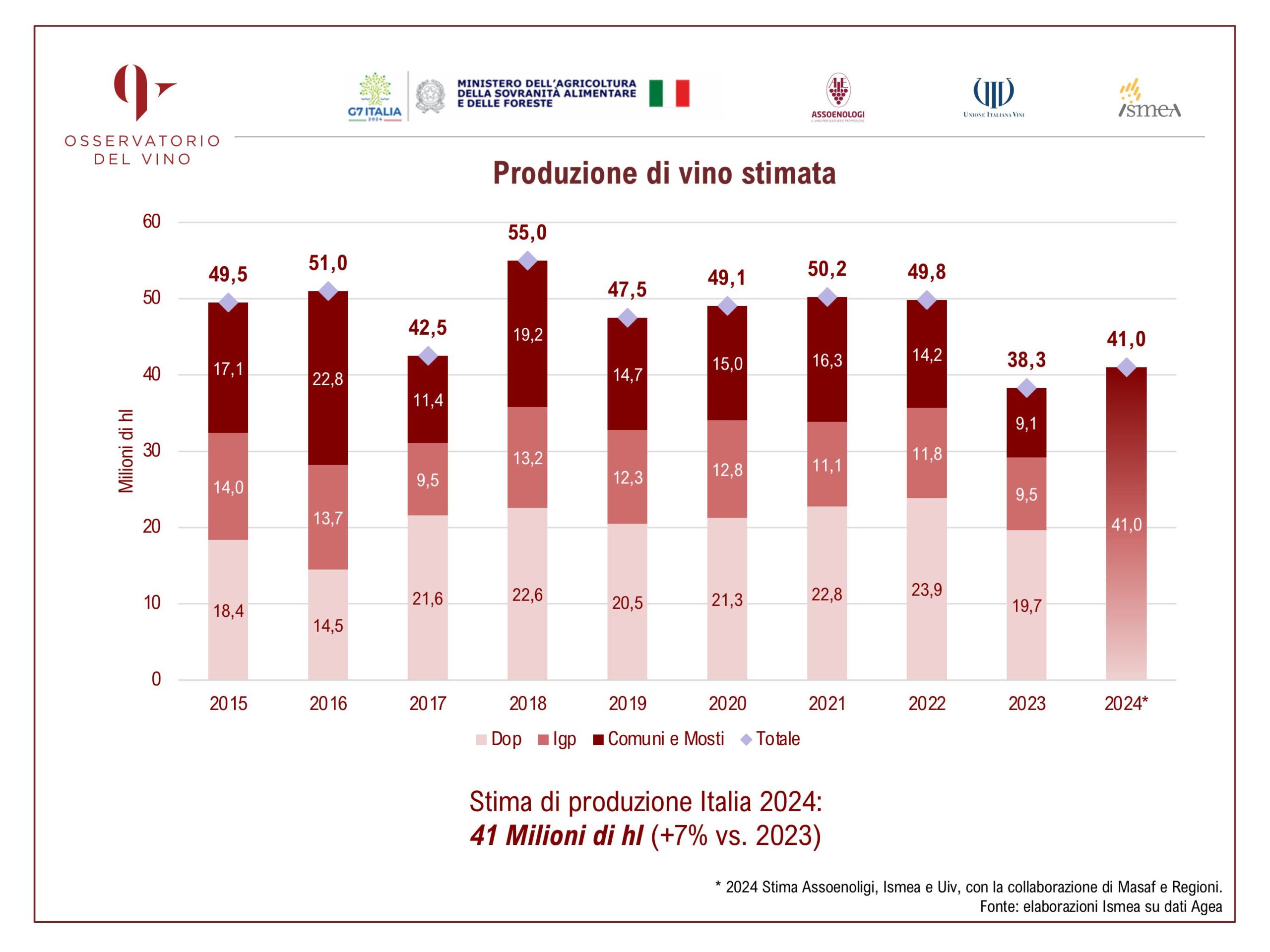

A 7% Increase Over 2023

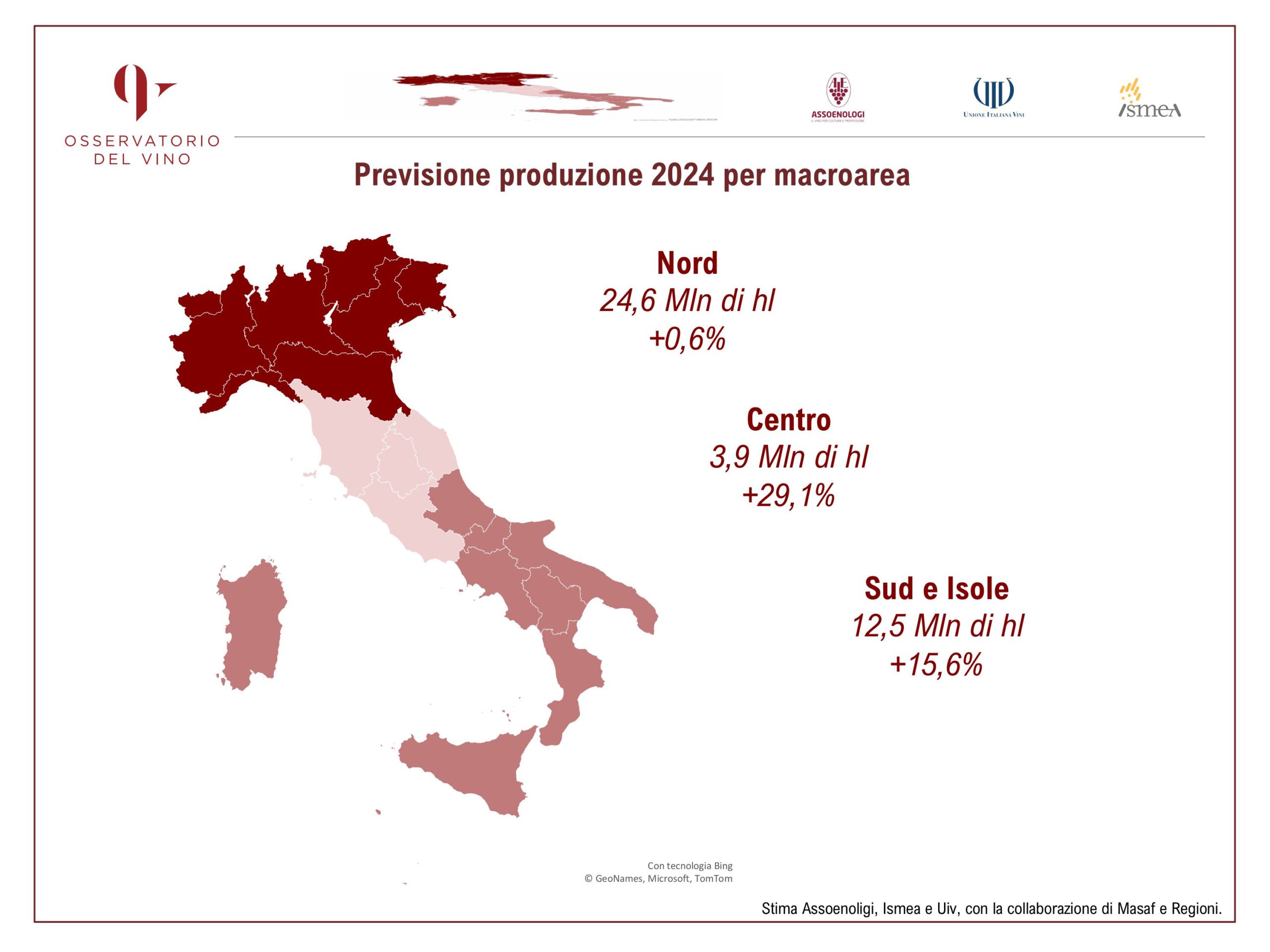

With an estimated production of 41 million hectoliters, the 2024 harvest shows signs of recovery compared to 2023 (+7%), although it is still 12.8% below the five-year average and falls short of the optimal target of 43-45 million hectoliters set by wine companies. This reflects a substantial hold in the North (+0.6% for the macro-region), accompanied by a significant recovery in the Center (+29.1%) and a moderate increase in the South (+15.5%). Overall, a year with a limited quantity but generally good quality, with several excellent peaks.

2024 Harvest: A Divided Italy

Italy has been divided into two halves. In the North, bad weather required more phytosanitary treatments for vineyards. Excessive rain caused a thinning of the bunches, reducing the vines’ productive potential. The harvest began 10-15 days later than last year and will continue until the end of October in the higher hill areas, such as Valtellina. This delay, particularly evident for late-ripening varieties such as Cabernet, Nebbiolo, and Raboso, will have a significant impact on the composition of the wines, affecting sugar content and acidity.

In the South, record heat and drought led to an earlier harvest, which began in the second half of July in Sicily and will continue until the first decade of November with the harvest of late-ripening grapes. The lower Adriatic region, including southern Abruzzo, Molise, and Puglia, was also affected. The persistent lack of rain caused drastic production drops, especially in areas where emergency irrigation was not possible.

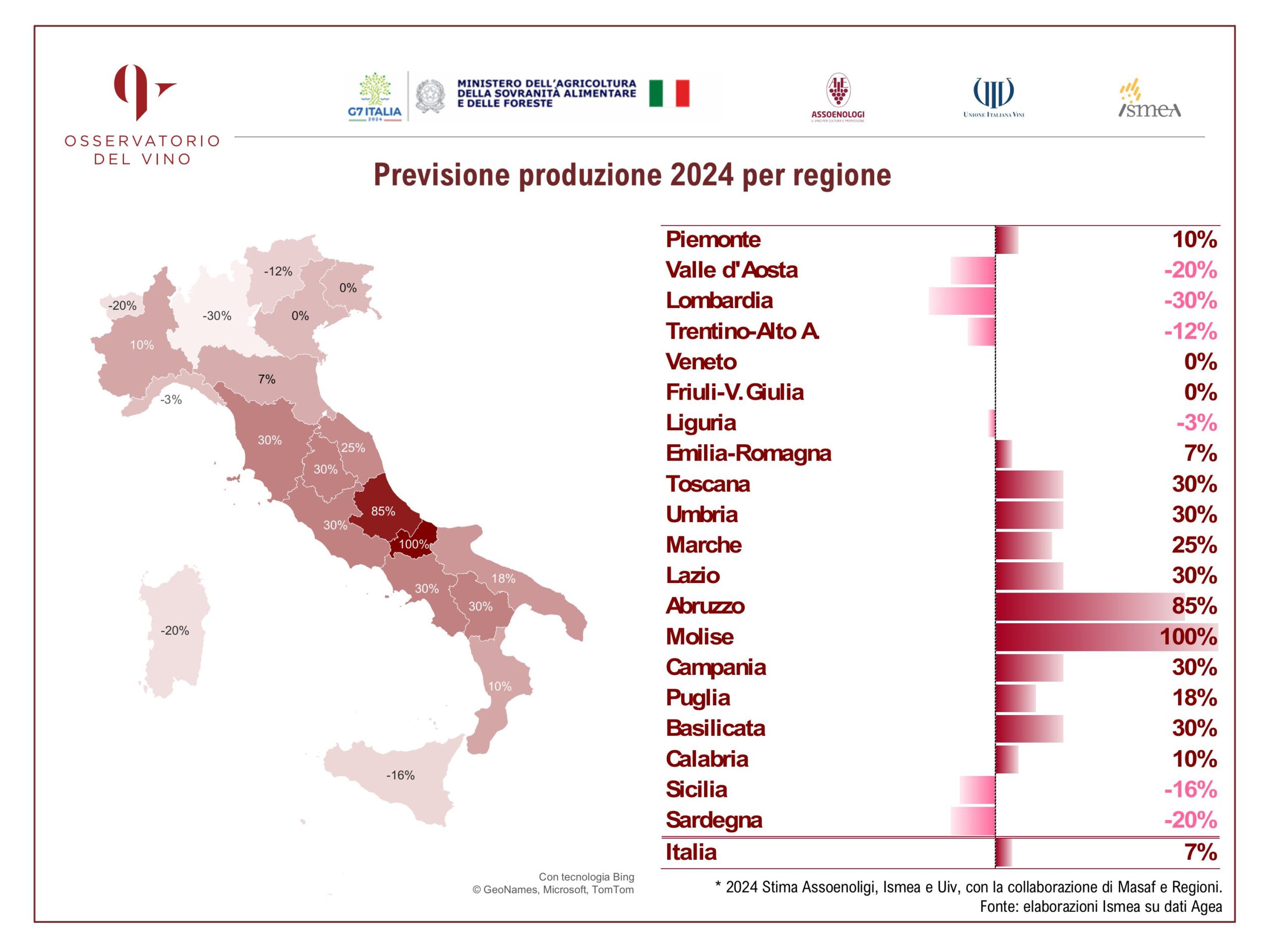

Molise and Abruzzo Take Off, Lombardy and Sardinia Struggle

The 2024 winegrowing year presents a very heterogeneous regional picture.

- Northwest: Piedmont recorded a good recovery (+10%), while Lombardy (-30%), Valle d’Aosta (-20%), and Liguria (-3%) experienced more or less significant declines.

- Northeast: Emilia-Romagna showed moderate growth (+7%), while Trentino-Alto Adige suffered a significant decline (-12.4%). Veneto and Friuli-Venezia Giulia remained stable.

- Center: The central regions recorded significant recoveries compared to 2023, with double-digit increases in Marche with +25%, Tuscany, Umbria, and Lazio with +30%.

- South: Abruzzo with +85% and Molise with +100% recorded the highest increases, followed by Basilicata and Campania (both +30%), Puglia (+18%), and Calabria (+10%). Sicily (-16%) and Sardinia (-20%), where drought now dictates the rules, were on the decline.

France Falls, Argentina Soars

Europe continues to face challenges in the wine sector, with overall production falling below average. France produced 39.28 million hectoliters (-18%), Germany 8.40 million (-2%), and Portugal 6.90 million (-8%). Spain, however, bucked the trend with a 20% increase, surpassing France as the second-largest producer. In the rest of the world, the picture is mixed. Argentina saw a 27% increase, Australia 21%, and South Africa a more modest 1%. Chile and New Zealand, on the other hand, experienced declines.”

The Challenge of Producing Great Wines in a Difficult Year

Riccardo Cotarella, president of Assoenologi, emphasized that “Despite the difficulties, what emerges as a determining factor for the final quality of the wines is precisely the work of the oenologists. Never before have we been called upon to demonstrate our scientific competence and technical knowledge as much as this year, to manage both vineyard and winery in the best possible way.

In the field, we had to adopt precise strategies to optimize the use of water resources, monitor the health status of the plants, and decide the exact moment of the harvest to obtain grapes at the peak of their potential. In the cellar, the work has been crucial to enhance the raw material, working with precision to compensate for the imbalances created by weather conditions.”

No to Vineyard Uprooting

Lamberto Frescobaldi, president of the Italian Wine Union (UIV), has emphasized the need for a more flexible Italian vineyard capable of adapting to production fluctuations. He argued that uprooting vines, as demonstrated by the 2011 experience, is not the solution and is ‘worse than hail during harvest,’ as it drains resources and poses a social risk to entire hilltop economies. Hillside vineyards play a crucial role in land management, helping to prevent landslides and wildfires. Instead, he proposed intervention tools to manage surpluses and support businesses during challenging years. Frescobaldi also stressed the importance of investing in innovation and promotion, rather than incentivizing those who want to leave the industry.

A Campaign to Defend Wine

According to Gaya Ducceschi, Head of Wine & Society and Communication of the Comité Européen des Entreprises Vins, the European wine sector is facing a crisis caused by the continuous decline in consumption, especially in traditional markets. To reverse this trend, it is necessary to improve the sector’s competitiveness, reduce costs, and win over new consumers. To this end, the CEEV has launched the VITÆVINO campaign to promote wine as an integral part of a healthy and sustainable lifestyle, underlining its cultural and social value. The campaign invites citizens, consumers, and industry operators to sign a declaration in support of wine and its role in society.

Tools to Support Young People and Women

For the president of ISMEA, Livio Proietti: “This year’s harvest estimates give us a complex picture but at the same time allow us to focus on some actions to be implemented.

Attracting young generations is the goal of specific study paths, able to anticipate trends adequately and use technology to the best advantage, enhancing wine to preserve and exalt its culture. In this direction, ISMEA intervenes with specific measures to support young people and women, such as Più Impresa and Generazione Terra. Then there is the issue of the continuous changes in consumption patterns that must be addressed and requires adequate and captivating storytelling that also touches on the theme of responsible consumption, for a real leap in quality for the sector.”