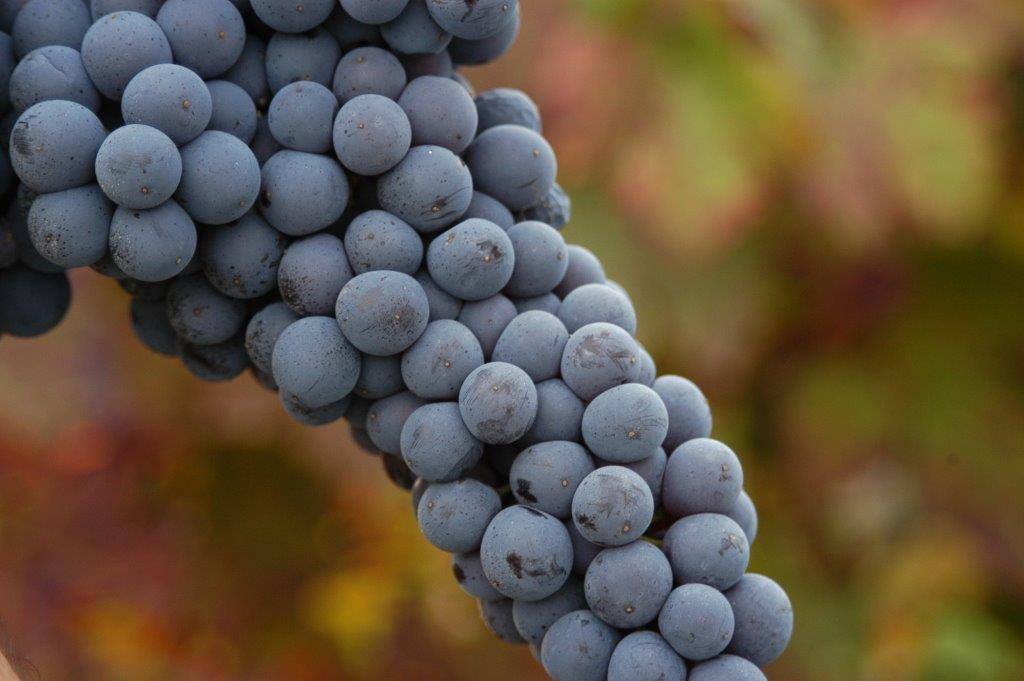

Two climatic factors characterized the 2023 wine year in Piedmont: record high temperatures and prolonged drought. No reversal of the trend from the year before, except in the grape harvest: this time the weather strongly affected by decreasing production by about 14 percent. 2.06 million hectoliters were produced compared to 2.26 million in 2022.

2023 is a vintage that technicians call “very good,” assigning the grapes an average quality of “eight stars” out of ten. Piedmont also confirms itself as the second region nationwide in terms of turnover impact with turnover for the wine sector growing to 1,362 million euros (it was 1,235 million in 2022). Exports are holding up: Piedmont’s PDO wines did better than the Italian average, Asti spumante did well even if still reds contracted.

This, in brief, is the analysis made by oenologists, agronomists and sector journalists in L’Annata Vitivinicola in Piemonte 2023, the annual publication edited by Vignaioli Piemontesi and Regione Piemonte in which they analyze technical data and evaluations on the harvest just past and on the general economic performance of the wine sector.

It’s a job that Vignaioli Piemontesi has been carrying out for more than 30 years, since 1992, meticulously collecting regional data on grape ripening and climatic trends in various wine-growing areas of Piedmont and carrying out a coordination activity of all the viticultural and agronomic technicians in the area.

“We are looking at a vintage year in which on the one hand we are giving great quality to the consumer, on the other hand with critical issues from a production point of view,” said Giulio Porzio of Vignaioli Piemontesi. “It is time to address the problems: water scarcity and diseases, first and foremost flavescence dorée, which together lower yields per hectare and therefore the income of winegrowers. This makes us extremely vulnerable. It is time to do and not to profess. We must look to the future and invest in new strategies to give viticulture in the Unesco hills and those who work there a tomorrow.”

Performances and competitive positioning of Piedmont wines in the market scenario

2023 represented a year with many complicated implications for the Italian wine world, not only for production but also for markets. Denis Pantini, head of Nomisma Wine Monitor, analyzed the performance of Piedmont wines, particularly abroad.

As for exports of Italian PDO wines (-0.3 percent in value, -3.9 percent in volume), those from Piedmont fared better than average, in the sense that Asti spumante PDO grew 5.2 percent in values and slightly declined in quantities exported (-0.9 percent).

Piedmontese PDO still reds, on the other hand, contracted by 2.6 percent in values and 5 percent in volumes (compared to a 5.6 percent and 8.1 percent drop, respectively, that affected the entire PDO red category).

Looking at the main export markets for Piedmontese PDO wines, the changes from 2022 manifested themselves differently. Thus, in the case of still reds and looking at values, the main declines affected Canada, Norway, Germany and the United Kingdom while at the opposite end there were increases in France and Sweden.

On the other hand, in the case of Asti Spumante, the value of exports (Jan-Oct 2023 vs. 2022) increased in Latvia (these are mostly re-exports to Russia), Germany, Uk, Poland and Austria while it decreased in the US, Mexico and Japan.

Finally, a look at the very long term. Beyond the conjunctural factors that have affected – and are also affecting this early 2024, among other things at risk of worsening in light of ongoing geopolitical tensions – the wine market with the effects described above, there are other elements-in this case structural-that must be taken into account to understand possible future trends in the sector. First and foremost is the demographic evolution of Italy and the approach to wine consumption by new generations.

Demographic forecasts released by Istat show a country that by 2050 will be less populous (-5 million inhabitants compared to today) and older (35 percent of the population will be over 65). This will necessarily result in less wine consumption (in quantity), which, in any case, has already dropped by almost 30 percent over the past two decades.

Therefore, in order to maintain the production structure of the Italian wine chain unchanged (with all the positive implications it expresses at the socio-economic level for the Country System and for individual territories), it will be necessary both to export more (also going to interest markets that are today little presided over by Italian producers) and to understand in time the evolution of the tastes and consumption habits of today’s young people.

Young people who, currently in the choice of buying a wine, seem to prefer attributes that are in part shared even with the generations of the less young (such as territorial origin, the enhancement of indigenous grape varieties), others indicated with greater emphasis (sustainable wines) but still others where the gap with the average Italian consumer is very evident. This is the case of “limited edition” wines (promoted by influencers or made in collaboration with companies in the world of fashion and fashion), but especially of wines suitable for mixology.

Figures from the 2023 harvest in Piedmont

The grape harvest was quite early, generally taking place between August and September. Among vineyards in Piedmont, wine production dropped 14% from the year before to 2.06 million hectoliters. In Italy, production was just under 39 million hectoliters (down 22 percent from 2022).

The harvest, however, is classified as very good in quality: from the analyses and evaluations carried out constantly by the technical service of Vignaioli Piemontesi, many grape varieties are placed between “eight stars” (Arneis, Favorita, Nascetta, Dolcetto, Grignolino, Nebbiolo Alto Piemonte, Chardonnay) and “eight and a half stars” (Cortese, Erbaluce, Moscato bianco, Timorasso, Barbera, Brachetto, Nebbiolo (Langhe).

Three peaks near excellence with nine stars: Freisa, Pelaverga Piccolo, Ruchè. Seven and a half stars to Vespolina, Sauvignon Blanc, Pinot Noir. “The most appreciable character of 2023,” the technicians write, “could be that of ‘downsized’ alcoholic potencies also more in tune with new market demands. In general, there are prospects for better balance and length in wines, as well as greater complexity: “It is necessary to be able to trace and appreciate in the wines also the imprint of the vintage as well as the territorial one.”

For the first year since 2017, Piedmont’s hectares under vine are declining: today they are 44,285 (they were 45,823 in 2022). Looking at the numbers, over the past ten years (2013 – 2022), the Piedmont vineyard has shown a basically stable trend with an increasing situation until last year. In 2013, Piedmont’s vineyard area had 44,169 hectares, in 2014 43,893, in 2015 43,553, in 2016 43,500, in 2017 44,202, in 2018 44,449, in 2019 44,677 hectares, in 2020 44,737 hectares, and in 2021 45,420. The recovery of the area under vines lost in the past (45,823 hectares) also continued in 2022, with a sharp increase over the 2013 value.

The production of DOC wines accounts for 94 percent with 1.95 million hectoliters declared in the 2023 vintage. There are 59 appellations with 18 DOCGs and 41 DOCs covering about 83 percent of the regional production; almost all from historic native grape varieties.

Positive economic data for Piedmont’s agribusiness sector to which wine also refers: according to the latest data from the Piedmont Region, the value of Piedmont production is 1,362 million euros out of an Italian total of 11,334 million euros. Piedmont is confirmed as the second region nationwide in terms of turnover impact.

An export that involves about 60 percent of the wine produced in Piedmont, of which 70 percent goes to EU countries and 30 percent to non-EU countries.

33% of wine production in Piedmont comes from the cooperative world: 35 cooperative wineries in Piedmont are associated with and represented by Vignaioli Piemontesi with about 8,000 members.

Slightly more than 19 million euros are the resources allocated by the Piedmont Region in the 2023/2024 annuity to the promotion on third-country markets measure of the CMO Wine for the internationalization and export of Piedmontese wineries, broken down as follows: 8.4 million euros for the promotion of wines on third-country markets measure; 6.9 million euros for the restructuring and reconversion of vineyards measure; and 3.8 million euros for the Investments measure.

7.1 million euros are the resources allocated by the Piedmont Region for the transitional biennium 2023 – 2024 for the submeasure 3.2 PSR 2014/2020, in support of information and promotion activities, carried out by producer associations in the EU internal market for the enhancement of Piedmontese productions covered by quality schemes.